ON THE “COVER”

Today’s “cover” picture is a view of 42nd Street in NYC between 8th Avenue and Broadway. This patch of 42nd Street looked a lot different in my teens and twenties (I am 68). Back then it was truly New York City’s “Porn Central” with X-Rated movie theatres, peep shows and one of the last of the city’s Burlesque theatres.

LBJ

TOOK THE IRT DOWN TO 4th STREET USA. WHEN HE GOT THERE WHAT DID HE SEE? THE

YOUTH OF AMERICA ON LSD!

While before I retired I may have been among the “last of the dinosaurs” preparing all my 1040s manually – in some ways I was way ahead of my time.

For example, I have been using acronyms in notes and correspondence to friends, family, and clients, and in my writings, for decades before the IM, DM and texting, beginning back when, while there were lots of twits around, none of them “tweeted”. It started when I put “HVD” in the “memo” of the paychecks I wrote for employees of the Art Center in Summit back in mid-February of 1980. I started using WTF in the early 90s.

Americans have always been fascinated with acronyms – “a word formed from the initial letter or letters of each of the successive parts or major parts of a compound term”. Like FYI for For Your Information.

The world of emails and text messaging has created a whole new appreciation for and vocabulary of acronyms – BTW (By The Way), LOL (Laughing Out Loud), MIRL (Meet In Real Life), TFB (guess).

In my wanderings on the web I found an online “Internet Acronyms Dictionary” and discovered that AAAAA was not a group for drunk drivers but the American Association Against Acronym Abuse.

Government, at all levels, has always been famous for its acronyms. We all know what the FBI, the CIA, and the DMV are. And, thanks to television, we are also aware of SWAT, JAG, CSI and NCIS.

The official code word for the President is POTUS – President Of The United States. However, when Trump was President the acronym represented a different title – Piece Of Totally Useless Shit.

The military is especially enamored of the practice. A PFC could be promoted to become a CPO. In military speak PABST does not refer to Blue Ribbon Beer but to Primary Adhesive Bonded Structure Technology. And let’s not forget the infamous WMDs – Weapons of Mass Destruction.

Some acronyms have become actual words. A classic example is “snafu”, a military acronym for Situation Normal, All Fouled (not the original word) Up. The word “radar” is actually an acronym for RAdio Detection And Ranging, as the word “laser” is for Light Amplification by Stimulated Emission of Radiation.

I was told many years ago by, I think, a teacher that the equivalent of the “n” word for persons of Puerto Rican extraction came from a US Immigration category stamped on the papers of certain individuals arriving on Ellis Island – Spanish, Portuguese, Indian and Colored - although I cannot find any real documentation of this online. I do know for a fact that I am a WASP (While Anglo Saxon Protestant).

It is, however, an “urban legend” that the “n” word for Italians came from the fact that, as illegal aliens in the 30s and 40s, they were With Out Papers, or With Out Passport. According to Wikepedia “wop” is taken from “the Neapolitan ‘guappo’, meaning dude or thug. The word defines those who belong to the Guapperia o ‘Camorra’, a criminal organization similar to the Sicilian Mafia located mostly in the province of Campania.

Acronyms are certainly in frequent use in my profession – taxes. The AGI (Adjusted Gross Income) has been around for at least as long as I have been in the business, and is now paired with the non-gift bearing MAGI (Modified Adjusted Gross Income). And we are all familiar with the dreaded AMT (Alternative Minimum Tax).

TRA 86 (the Tax Reform Act of 1986) created a whole new set of acronyms. Under TRA 86 a PAL (Passive Activity Loss) needs a PIG (Positive Income Generator). There is ACRS (Accelerated Cost Recovery System) and MACRS (Modified Accelerated Cost Recovery System), both the result of FACRS (Foolhardy Acts of Congress under the Ruse of Simplification).

Many taxpayers save for retirement with either an IRA (Individual Retirement Account), a SEP (Simplified Employee Pension plan) or a SIMPLE (Savings Incentive Match PLan for Employees). One of the more complicated areas of the Tax Code concerns the NOL (Net Operating Loss).

As I have said before at THE WANDERING TAX PRO, I have often found errors in tax returns prepared by a CPA.

I belong to the NATP (National Association of Tax Professionals) and, at one time, the NSTP (National Society of Tax Professionals) – as well as AAA (Automobile Association of America) and AARP (American Association of Retired Persons). Over the years I have also briefly belonged to the ASTP (American Society of Tax Professionals) and the NSA (National Society of Accountants). I have often attended tax seminars sponsored by the CSEA (California Society of Enrolled Agents).

I have been using WTF for years. Back before my mentor Jim Gill retired and handed me his tax practice, he had given me a return to work on. Included with the client’s “stuff” was a listing of deductions on which there was one item whose nature I was unsure of. So I wrote “WTF?” next to it and put it in the “Need More Information” box. A few days later Jim said that the client had been in and they were not sure what I had meant – but thought it might be “What’s This For?”. I told him he was close and explained what it actually stood for.

I use certain specific acronyms in my blog postings. Those of you who read THE WANDERING TAX PRO are aware that I hate GD extensions. A client asked what the GD stood for and I told him “exactly what you think it stands for!” It is not Government Deferred or anything like that. I often speak ill of the DFB’s in Trenton or Washington, a reference to our federal and state elected representatives, and provide the “clean” version as Damned Fool Bureaucrats, although that is not really what it stands for. When I discuss a FU you could interpret this as a Foul Up, but you would be wrong. Again, it is exactly what you think it stands for. FFR is For Future Reference and SGTM is Sounds Good To Me.

Regular

visitors to THE WANDERING TAX PRO know that I end each day’s post with TTFN (Ta

Ta For Now).

HOW TO EXPERIENCE THE JOY OF AVOIDING TAXES

You are paying too much income tax – and it’s nobody’s fault but your own! You don’t have to wait for Congress to pass tax legislation – you can enact your own tax cut through year-round tax planning.

I have been preparing 1040s for individuals in all walks of life since February of 1972. I have compiled a collection of tax planning and preparation advice, information and resources from my 50 years of experience as a professional tax preparer and over 20 years of posts from my tax planning and preparation blog “The Wandering Tax Pro” in a new book that help you to experience and enjoy THE JOY OF AVOIDING TAXES.

Click here to see a copy of the book’s Index.

The cost of this unique book is only $11.25 plus $3.16 postage.

Send your check or money order payable to TAXES AND

ACCOUNTING INC FOR $14.41 and your address to –

TAXES AND ACCOUNTING, INC

THE JOY OF AVOIDING TAXES

POST OFFICE BOX A

HAWLEY PA 18428

BETCHA DIDN’T KNOW

As we all know Catholic priests are required to take a vow of “celibacy”, which is defined as “the state of abstaining from marriage and sexual relations”.

Celibacy is a “discipline” of the Catholic Church, something that can be changed, and not a “dogma”, which is considered divinely revealed truth from God and cannot be changed or revised. There is some religious and historical basis for the vow of celibacy, but nowhere in the Bible does it explicitly require priests to be celibate. Actually, for the first thousand years of Christianity it was not uncommon for priests to have families. The first pope, St Peter, was a married man. The vow of celibacy for priests was officially formalized by the Second Lateran Council held in 1139, and the rule was reaffirmed in 1563 by the Council of Trent.

But the true reason has nothing to do with religion – like just about everything else it comes down to economics. It is not about what is written in the Scriptures but what is written in a ledger.

In the Middle Ages wealthy Catholics believed that their earthly goods were a barrier to eternity in Heaven, and turned over portions of their wealth to priests and bishops as a “down payment” on a spot in Heaven. As a result, priests became rich in both money and land.

Normally,

when a person dies his wealth is passed on to his family – his wife and

children. But the Catholic Church wanted

the wealth to remain with the Church.

Prohibiting priests from marrying and having children, and therefore no

“heirs”, made sure the money and property acquired during a priest’s life would

go to the church when he died.

In the history of our country no one individual has done more damage to America, the American people, American democracy and true American values than Donald J Trump.

Trump is a totally worthless piece of garbage, completely devoid of intelligence, integrity and humanity who does not possess a single redeeming positive human quality or value. He has not performed a single totally unselfish act in his adult life.

The greatest threat to America

is not ISIS, Russia or China – it is Trump and today’s Trump-embracing

Republican Party.

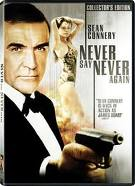

NEVER MY LOVE

Despite what the title of the remake of the James Bond film “Thunderball” suggests, sometimes it is OK to say “never”.

When it comes to taxes I can think of at 10 examples -

(1) NEVER file a fraudulent return.

As the former British Chancellor of the Exchequer Denis Healey said - “The difference between tax evasion and tax avoidance is the thickness of a prison wall”.

Tax avoidance is the lawful and ethical use of accepted procedures to reduce your tax liability. Tax evasion is a willful misrepresentation or concealment of information. Despite growing public acceptance of cheating on tax returns, reckless tax evasion is a very dangerous matter. There are many legal ways to reduce your tax liability – too many to risk your future with tax fraud.

Normally the IRS has 3 years to audit a tax return. If fraud can be proven the Service can go back and audit every return you have ever filed.

(2) NEVER pay a person to prepare your tax return who has not registered with the IRS and received a Preparer Tax Identification Number (PTIN).

And never use a preparer who will not sign the finished returns (if he/she refuses to sign you refuse to pay), or who charges a fee based on the amount of your refund.

(3) NEVER ignore a notice or correspondence from the Internal Revenue Service or a state tax agency.

If you receive a notice in the mail give it to your tax preparer immediately. If you prepared your own return and do not understand the notice, consult a tax professional.

(4) NEVER assume that a notice or bill you receive from the Internal Revenue Service or a state tax agency is correct.

Do not automatically pay the balance due on a notice from the IRS or the state. More often than not the notice is wrong. To repeat - If you receive a notice in the mail give it to your tax preparer immediately. If you prepared your own return and do not understand the notice consult a tax professional.

(5) NEVER hold up filing your return, or an automatic extension request, by the April statutory deadline simply because you do not have the money to pay the tax you owe.

It is vitally important that you file your 1040 or 1040A, or 4868 extension application, by the April deadline, even if you cannot pay all or any of the tax due on the return. Along the same lines, if you have requested an extension be sure to get your tax return in the mail by October 15th, again even if you cannot pay all or any of the tax due. The penalty for paying late is .5% (1/2 of 1%) of the tax due per month. The penalty for filing late is a full 5% of the tax due per month – 10 times more!

(6) NEVER respond to an unsolicited email or phone call allegedly from the IRS.

As a fellow tax blogger put it, “If the IRS sends you a notice via e-mail, the IRS did not send it”. The IRS does not send notices via e-mail, and never initiates contact by telephone.

If you receive an email allegedly from the Internal Revenue Service delete it unopened. Don't click any of the links - the link will either try to collect your bank information or it will dump malware on your computer. And if you get a phone call tell the caller to put it in writing and hang up.

(7) NEVER have your tax returns prepared by one of the “fast food” commercial tax preparation chains (you know who I mean).

You will pay gourmet restaurant prices (Henry and Richard ain’t cheap!) for fast food service and could be pressured to purchase unnecessary additional products and services.

(8) NEVER assume that just because a person has the initials CPA after his/her name that he/she knows his/her arse from a hole in the ground when it comes to preparing 1040s.

The only initials that have any bearing on 1040 competence and currency is “EA” – for Enrolled Agent (an EA is not an employee or representative of the IRS), “ATP”, for Accredited Tax Preparer, and “ATA”, for Accredited Tax Advisor.

There are many CPAs out there who are indeed competent and current in 1040 taxation, and it may actually be possible that the best tax preparer, at the best price, for your particular situation is a CPA. But this is only because of the education, experience, ability, temperament, and other factors that are specific to that individual preparer and absolutely nothing to do with the initials CPA.

(9) NEVER use a tax resolution company that promises to get you “off the hook” with the IRS for “pennies on the dollar”.

If you find yourself with a huge balance due to your Uncle Sam, including excessive accrued penalties and interest, do not, under any circumstances, call upon a company whose tv ads promise to resolve your IRS debts for “pennies on the dollar” for help. This is a promise that no one can make!

(10) And perhaps the most important – NEVER accept tax advice from anyone other than a professional tax preparer.

Don’t listen to a broker, a banker, an insurance salesman, your neighbor, or your Uncle Charlie! While for the most part those who give you free tax advice are doing so out of a genuine desire to help you, and sincerely think they know what they are talking about. But most of the time they don’t.

One

final NEVER. As a radio ad from a few

years ago told us, NEVER wear a fanny pack!

Keep up-to-date on federal and NJ state income taxes by becoming a regular visitor to my tax planning and preparation blog THE WANDERING TAX PRO.

Each week, usually on Tuesday, you can check out “What’s the Buzz, Tell Me What’s A Happennin’? – a compilation of online tax-related posts, articles and resources.

WHAT

I BELIEVE

I thought it might be helpful

for those who are interested in understanding the thinking behind my posts and

comments on social and other media, and a good and helpful personal experience,

to identify in detail my political beliefs and philosophy.

* First and foremost, I very

sincerely believe that in the history of our country no one single individual

has done more damage to America, the American people, American values, and

American democracy than Donald Trump. Opposing, denouncing and

disavowing Trump has absolutely nothing to do with partisan politics – it is

about patriotism.

* I am not a “card-carrying”

member of the Democratic Party or Republican Party or any other

Party. In the past I have voted for Democratic, Republican and

third-Party candidates in various elections, based on the issues and the

individual candidates. However. I will never again for the rest of

my life vote for any Republican candidate in any election at any level unless

there is a drastic change to the leadership and agenda of the Republican Party.

* The application of strict

libertarian/conservative beliefs and of strict communist/socialist beliefs are

both based on the false assumption that all individuals are honest and enter

each transaction and relationship with complete honesty and

integrity. Of course, we all know this is not true. The

government has the right, and obligation, to enact restrictions and regulations

to protect individuals from dishonesty and harm. And the government

must recognize that the rights and freedoms of the individual citizen are just

as important as, if not more important than, the rights of the “state”.

Winston Churchill is credited

with saying, “If you’re not a Liberal at age 20 you have no

heart. If you’re not a Conservative at age 40 you have no head.” I

believe to be effective and successful a government needs both heart and head.

* I firmly believe that my

current financial and social position is the direct result of the actions and

decisions I have made in my life, both good and bad. I do not blame

the wealthy, “the man”, illegal immigrants, minorities, liberals,

conservatives, or anyone or anything else for my current situation or my lack

of wealth. I believe I, and I alone, am personally responsible for

my current situation and take full responsibility for my actions and decisions

– as should everyone.

I do acknowledge that other

groups of individuals may have faced more, and different, obstacles than I have

as a WASP growing up in northeast America, but history is full of stories of

individuals with a variety of “handicaps” successfully overcoming obstacles of

all kinds.

* It is not the responsibility

of the government to “redistribute wealth” or provide guaranteed income or

welfare benefits to citizens. However, it is beneficial to society

for government to provide appropriate benefits and assistance to families with

dependent children (for the benefit of the children), veterans and individuals

with physical and mental illness and disability.

* I believe that government has

a fiduciary requirement to be fiscally responsible with the money it raises via

taxes, fees and other sources. Like a family or a business, it

should spend and borrow judiciously.

As the Concord Coalition states

- “Fiscal responsibility is essential to creating a better, stronger, more

prosperous nation for the next generation. The choices we make today -- or fail

to make -- will determine what kind of future our children and grandchildren

inherit 20 and 40 years from now.”

* In addition to exercising

fiscal responsibility the government must also exercise responsible stewardship

of our country’s lands, waters, minerals, timber, air, and all other aspects of

the “environment”.

BTW – I fully believe in

science, whether it involves global warming, virus and disease prevention, or

whatever.

* A healthy and well-educated

populace is beneficial to and important for the security and the future of both

the individual citizen and the state. The government should provide

or enable universal access to free or reasonably priced health care and to continuing

education and “pre-Kindergarten” education opportunities.

A well-educated and intelligent

electorate is especially important for the continuation of our freedom and

democracy. In the past few years, we have seen the danger and damage

that ignorant and “under-educated” voters can do.

* Social Security and Medicare

are not discretionary government welfare or “entitlement”

programs. Social Security is a government-maintained employee

retirement plan and Medicare is a government-maintained employee health

insurance plan – both paid for by employee and employer contributions.

* The government does not have

the right to prohibit, restrict or inhibit the sexual relationship or activity

of two freely consenting adults who are both fully capable of freely

consenting.

* Marriage is a legal

contract. The government does not have the right to prohibit,

restrict or inhibit the ability of two adults capable of free consent to enter

into a marriage contract based on their sex or sexual

orientation. Nor should it restrict or inhibit the free and equally

consented dissolution of a marriage contract.

* The strict separation of

Church and State, as outlined in the Constitution, is a foundation of American

democracy. Every American has the right to worship and believe as he

or she so chooses – or to choose not to worship or believe. The

government cannot force anyone to choose one religion and set of beliefs over

any other, or to choose any religion or beliefs. No specific

religion, sect or church can dictate government policy or

legislation. The specific religious beliefs of a religion, sect or

church must never be legislated.

If the religious beliefs of

your chosen sect or religion tells you that abortion is wrong – don’t have an

abortion. If the specific religious beliefs of your chosen sect or

religion tells you that homosexuality and same-sex marriage is wrong – don’t

practice homosexuality and do not marry someone of the same sex. But

you cannot force someone with different religions beliefs, or no religious

beliefs, to act in accordance with the specific religious beliefs of your

chosen sect or religion – and most definitely not via legislation or government

regulation.

America is not a “Christian

country”. The greatest threat to the future of America and American

democracy today is the Republican Party because it is totally controlled by the

repressive so-called “Evangelicals” of the extreme Christian fundamentalist

“Religious Right”, whose agenda is directly contrary to the true teachings of

Christ and contrary to true conservative policy.

As an aside, while I

acknowledge and appreciate the “good works” performed by legitimate organized

religion and genuinely religious individuals, I truly believe that in the

history of the world more evil than good has been done in the name of a god,

God or religion.

* I believe the 2nd Amendment

has absolutely nothing whatsoever to do with the unrestricted right of an

individual to own and carry any kind of gun.

The Amendment reads – “A

well-regulated Militia being necessary to the security of a free State, the

right of the people to keep and bear Arms shall not be infringed.” U.S.

Supreme Court Warren Burger, nominated to the Court by Nixon, correctly

observed - “The real purpose of the Second Amendment was to ensure that

state armies – the militia – would be maintained for the defense of the state.” The

state militias that existed in the time of the Revolution have since been

replaced by state police, the National Guard and the US Armed

Forces. State militias no longer exist – so the Second Amendment is

obsolete and has no application today.

I believe no individual of any

age has a need or a right to own and carry an assault weapon or an

AK-anything. It is not needed for hunting, target practice or

protection. The one and only purpose of an assault rifle is in its

name – to assault. And ownership of a “normal” gun or rifle must be

treated in the same manner we treat automobiles and driving.

Another aside – while it is

true that guns don’t kill people, people kill people, people with guns kill a

lot more people more quickly and efficiently than people without guns.

* I believe the one and only

purpose of the Tax Code is, or should be, to raise the money necessary to fund

the government. The Tax Code should be fair and equitable and treat

all taxpayers equally, be consistent and treat specific conditions, situations,

and activities the same in all instances, and encourage savings, investment,

and growth. It should not be used for social engineering, to

redistribute income or wealth, or to deliver social welfare and other

government benefits, to encourage or discourage certain economic decisions

(other than savings, investment, and growth), or to provide exclusive benefits

for specific industries, business activities, or classes of taxpayers.

The government should not

“punish” ambition, entrepreneurship and success. I do not believe

the answer to all our problems is to excessively tax the rich simply because

they can afford it. I do not believe in a “progressive” tax rate

schedule. I believe every American should pay his or her “fair

share” of taxes – but if it is fair for a person with net income of $50,000,

after appropriate deductions, to pay, let’s say, 10% of that income in tax then

a person with net income of $1 Million or $10 Million or $100 Million of net

income should also pay 10% in tax. The person with millions in net

income is obviously paying more tax than the person with $50,000 of net income,

but not disproportionately so.

* Bill Clinton said in a

television interview given after leaving office that the difference between his

and the Democratic Party’s world view and that of then President Bush and the

Republican Party was that he and the Democrats believed America should work and

act together with the other nations of the free world whenever possible and act

independently only when it was absolutely necessary, while Bush and the

Republicans believed America should act independently whenever possible and

work with other countries only when absolutely necessary. I support

the world view of Clinton and the Democratic Party.

Your thoughts?

ALWAYS LEAVE ‘EM LAUGHING

A Republican Senator running for re-election was walking through Washington when he spotted a boy on the sidewalk selling week old "Republican Puppies".

Delighted he resolved to come back with reporters in a few weeks for his campaign. When he came back the boy was now selling "Democratic Puppies".

Disgruntled he asked why they were no longer Republican Puppies.

The boy said - "They

used to be Republican Puppies, but now they've opened their eyes."

TALK

TO YOU NEXT MONTH

COPYRIGHT © 2022 by Robert D Flach